- E8 Sourcing Insights

- Posts

- Water Purifiers Hit $92B: The Clean Water Revolution

Water Purifiers Hit $92B: The Clean Water Revolution

Unlock the growth potential in the water purification market

Market Overview: Water Purification Industry's Expanding Horizons

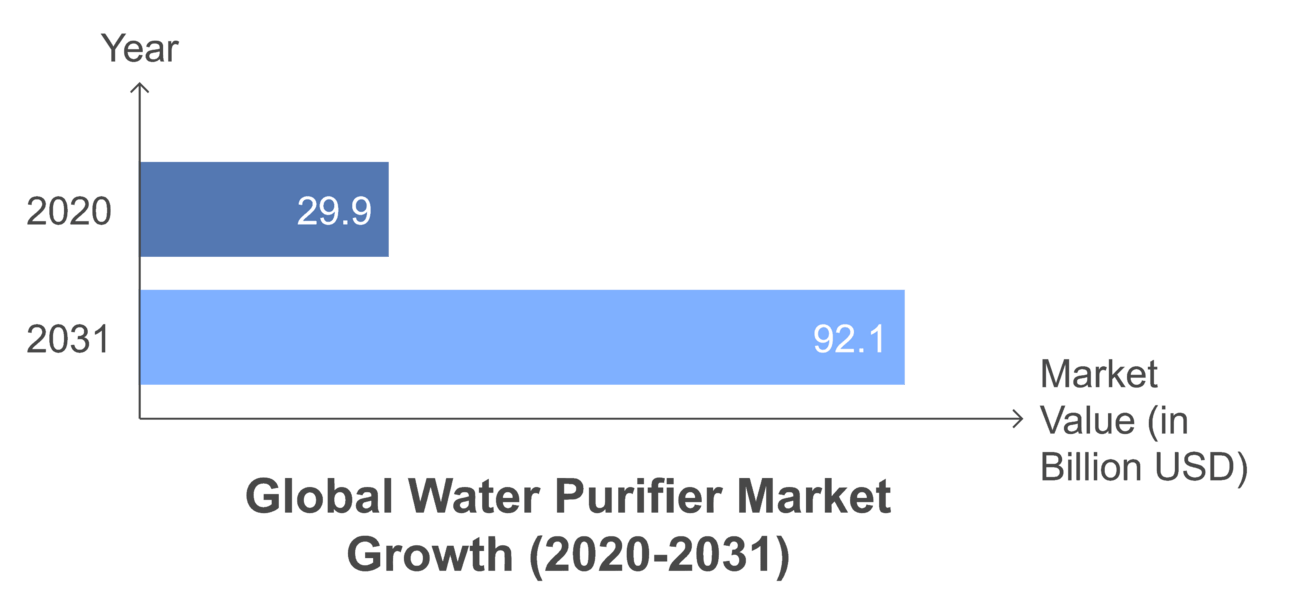

The global water purifier market, valued at $29.9 billion in 2020, projects unprecedented growth to reach $92.1 billion by 2031, showing robust CAGR of 10.1%. Increasing health consciousness and deteriorating water quality drive this remarkable expansion across developing economies. Asia-Pacific leads with 69% market share, demonstrating strong adoption rates in urban centers.

LAMEA regions show the highest projected CAGR at 12.3%, powered by rapid infrastructure development and rising health awareness initiatives. Europe and North America display mature market characteristics with CAGRs of 9.1% and 8.4% respectively, focusing on technological innovation and premium solutions.

Key Drivers: Why Water Purifiers Are Becoming Essential

The residential water purifier segment offers exceptional e-commerce potential, with online channels showing unprecedented growth. Digital platforms enable direct market access while reducing traditional retail barriers.

1. Direct Sales Growth: Digital channels enable higher margins by eliminating traditional retail markups and creating direct customer relationships.

2. Smart Features: Connected systems create opportunities for premium positioning online while enabling valuable data collection.

3. Urban Focus: City dwellers increasingly prefer purchasing purifiers through e-commerce platforms for convenience and selection.

4. Quality Demand: Health-conscious consumers seek premium solutions via digital channels while valuing detailed product information.

5. Service Innovation: Online platforms enable comprehensive post-purchase support integration through automated maintenance scheduling.

Competitive Landscape: Key Players in the Water Purifier Market

The water purifier industry features intense competition between established leaders and innovative newcomers, with market dynamics driven by technological advancement and expanding global demand. Regional players increasingly challenge international brands through localized solutions.

Established Brands:

A. O. Smith Corporation: Leading global provider of advanced water treatment technologies and smart purification solutions.

SUEZ Water Technologies: Pioneering comprehensive purification systems with integrated service support across multiple markets.

LG Electronics: Premium manufacturer combining innovative smart features with advanced filtration technology worldwide.

Eureka Forbes: Established market leader delivering specialized residential and commercial purification solutions internationally.

Emerging Players:

HaloSource Inc.: Developing sustainable purification technologies through innovative membrane solutions worldwide.

Kent RO System Ltd.: Expanding market presence through advanced yet affordable purification technologies.

Tata Chemicals Ltd.: Building comprehensive water management solutions for diverse market segments.

Best Water Technology: Introducing disruptive filtration technologies across emerging markets globally.

Market Segmentation:

Technology: Reverse osmosis dominates with UV and gravity-based systems gaining market share.

End-user: Residential segment leads while commercial applications show significant growth potential.

Distribution: Retail stores maintain dominance with e-commerce channels rapidly expanding reach.

Region: Asia-Pacific commands largest share while LAMEA demonstrates highest growth rate.

Emerging Consumer Trends in Water Purification

E-commerce platforms revolutionize water purifier sales through enhanced product discovery and support. Digital channels create unique opportunities for brands while simplifying consumer purchase journeys.

1. Smart Device Integration: Mobile applications enable real-time water quality monitoring while providing automated maintenance alerts and performance tracking for optimal system operation.

2. Subscription Services: Monthly filter replacement programs create predictable revenue streams while ensuring consistent customer engagement through automated delivery and monitoring.

3. Digital Consultation: Online platforms leverage video technology to provide personalized water quality assessments and detailed product recommendations for specific needs.

4. Eco-Friendly Focus: Sustainable filtration solutions gain popularity through digital education campaigns highlighting water conservation and environmental impact reduction methods.

5. Premium Adoption: Advanced purification systems command higher margins through comprehensive online education and feature comparison tools that demonstrate value.

Popular Items:

Smart RO systems with performance monitoring features.

Space-saving purifiers for urban apartments.

Multi-stage systems with mineral enhancement.

Distribution Channels:

Direct-to-consumer websites with support services.

E-commerce marketplaces with multiple brands.

Specialized digital water quality retailers.

Case Study: Kent RO's Digital Transformation

Kent RO demonstrates successful digital transformation through comprehensive manufacturing excellence and innovative online strategies. Their focus on strategic supplier relationships and advanced quality control systems drove 74% year-over-year online sales growth while maintaining premium market positioning and exceptional customer satisfaction rates in competitive e-commerce channels.

Key Success Factors:

Quality Program: Implemented comprehensive supplier certification and monitoring systems ensuring consistent production standards across manufacturing partners worldwide.

Digital Platform: Built sophisticated e-commerce infrastructure integrating sales, support, and maintenance services while providing seamless customer experience.

Testing Protocol: Established rigorous quality control processes throughout the supply chain, enabling premium positioning in competitive online marketplaces.

Market Analysis: Leveraged advanced customer data analytics to guide product development decisions while ensuring alignment with online buyer preferences.

Lessons Learned:

Quality Controls: Strategic supplier management protocols ensure consistent product performance while building customer trust.

Support Systems: Comprehensive digital service infrastructure enables successful e-commerce operations and customer retention.

Direct Partners: Strong manufacturing relationships provide competitive advantages in pricing and product innovation.

Data Insights: Detailed customer feedback analysis guides effective product development and market positioning.

Kent RO's journey demonstrates how e-commerce brands can scale successfully through strategic manufacturing partnerships while maintaining premium quality standards and customer satisfaction in digital channels.

Risks, Challenges, & Solutions

1. Technology Adoption:

Challenge: Consumer hesitation towards advanced purification system implementation and maintenance.

Solution: Comprehensive educational programs demonstrating clear benefits and simplified operation.

2. Price Sensitivity:

Challenge: High initial purchase costs limiting market penetration in price-sensitive regions.

Solution: Innovative financing options and subscription models improving product accessibility.

3. Infrastructure Requirements:

Challenge: Complex installation and maintenance needs deterring potential system adoption.

Solution: Development of user-friendly systems with simplified installation and maintenance.

4. Market Competition:

Challenge: Proliferation of unverified products compromising industry quality standards.

Solution: Implementation of standardized certification programs ensuring product reliability.

5. Environmental Impact:

Challenge: Significant waste generation from filter replacement and water rejection.

Solution: Advanced recycling programs and water recovery system development.

Future Outlook & Niche Markets

The water purifier e-commerce sector approaches significant transformation as digital sales channels mature and technology integration creates unprecedented opportunities. Online platforms enable unique market access while smart features and comprehensive service integration create substantial differentiation possibilities for innovative retailers.

1. AI Features: Advanced machine learning systems optimize purification performance while predicting maintenance requirements for proactive service delivery.

2. Connected Solutions: IoT integration enables comprehensive system monitoring while creating recurring revenue through subscription-based maintenance programs.

3. Green Innovation: Next-generation filtration methods maximize efficiency while minimizing waste through intelligent water conservation technology.

4. Health Tracking: Sophisticated sensors provide detailed water quality analysis while enabling personalized health recommendations through data integration.

5. Business Focus: Specialized commercial purification systems serve diverse industry requirements while opening new market segments for online retailers.

Emerging Opportunities:

Specialized water testing and consultation services.

Custom filtration solutions for specific contaminants.

Premium installation and maintenance programs.

Automated filter replacement subscriptions.

Regional Growth:

Asia-Pacific leads with 69% market share and rising online sales.

LAMEA shows highest growth potential at 12.3% CAGR.

Water Purification Supplier 1

Shenzhen Angel Drinking Water Equipment Co., Ltd

Founded in 1996, Shenzhen Angel has grown to become China's leading water equipment manufacturer with a 60% domestic market share. Operating from a 3,000m² automated production facility in Shenzhen Hok Chau Hang Fung Industrial City, the company produces 500,000 units monthly. Their comprehensive operations include R&D, manufacturing, and extensive quality control, backed by a strong international presence and systematic after-sales service.

Location: Shenzhen, China.

Products: Water production lines, RO water treatment machines, automatic water bottling machines, bottle blow moulding machines, water vending machines, water dispensers, pipeline water systems.

Certifications & IP: ISO 9001, CE Approval, WQA Member, China Famous Brand Certificate, China Environmental Protection Product Certificate, 3 patents, 13 trademarks.

Notable Clients: Mitsubishi, LG, Siemens, Hitachi.

Unique Strength: Pioneered the water ticket pre-sale and equipment bundling model that revolutionized China's water dispenser retail market.

Contact: Angel Drinking Water Website.

Phase 1 Supplier Score: 70/100 – based on an evaluation using Tianyancha Business Intelligence.

Water Purification Supplier 2

Shenzhen Hidly Water Purification Technology Co., Ltd.

Established in 2009, Hidly Water Treatment has grown into a specialized manufacturer of water purification equipment in Shenzhen. The company focuses on domestic and kitchen water purification systems, with extensive capabilities in precision mold development. Their integrated operations encompass research, development, and production of comprehensive water treatment solutions, serving both local and international markets.

Location: Shenzhen, China.

Products: RO water filters, UF water filters, faucet filters, kitchen water filters, desktop water filters, hydrogen water bottles.

Certifications & IP: RoHS, CE Certification.

Notable Clients: Invigorated Water, Ecological Laboratories, Imperial Systems, Lifestyle Ventures.

Unique Strength: Complete in-house mold design and manufacturing capabilities enabling customized water purification solutions.

Contact: Hidly Water Purification Website, Alibaba.

Phase 1 Supplier Score: 81/100 – based on an evaluation using Tianyancha Business Intelligence Reports.

Water Purification Supplier 3

Ningbo Hidrotek Co., Ltd.

Established in 2003, Hidrotek operates from a 22,099m² facility as a leading manufacturer of water filtration and purification systems. With six production lines and an annual output of 503,400 units, the company maintains rigorous quality control through 34 QA/QC inspectors. Their R&D team of 35 engineers drives innovation in water treatment solutions, serving global markets.

Location: Ningbo, China.

Products: RO systems, water filters, membranes, water softeners, water dispensers, industrial water treatment equipment.

Certifications & IP: CE, NSF, EMC, LVD Certification, 267 patents, 100 trademarks.

Notable Clients: H2one Water Solutions, Airo Products, Quick Tech, Meetec Marketing.

Unique Strength: Large-scale R&D capability with 35 specialized engineers, including postgraduate and graduate-level researchers.

Contact: Alibaba.

Phase 1 Supplier Score: 81/100 – Learn more about how we use Tianyancha Business Intelligence Reports to evaluate suppliers in our Academy.

China Exhibitions: Sourcing Water Purification Systems

Here are a few upcoming events that should be on your radar:

Guangdong International Water Treatment Technology & Equipment Exhibition: Mar 5-7, 2025, Guangzhou – South China's premier spring water industry event, spanning 36,000 square meters with over 800 exhibitors. The exhibition comprehensively covers industrial, municipal, and residential water treatment solutions, featuring 20,000+ products across membrane technology, filtration systems, and end-user purification equipment. Particularly valuable for sourcing partners in RO systems, ultrafiltration technology, and commercial water purification solutions.

Aqatech China: Dec 11-13, 2024, Shanghai – Asia's leading water technology exhibition covering the complete water treatment value chain. Hosted by the prestigious RAI Exhibition Group, this event showcases cutting-edge innovations in water purification, smart water management, and sustainable solutions. The exhibition uniquely combines domestic manufacturing capabilities with international technology exchange, featuring the Innovation Lab showcase area and significant presence of global industry leaders.

Xiamen International Water and Air Purification Industry Expo: Nov 28-30, 2024, Xiamen – A focused exhibition spanning 13,000 square meters with 500 booths at the Baixiang Convention Center. The event brings together 500+ domestic manufacturers and international buyers, particularly from Southeast Asia and Arab countries. Notable for its concurrent Asian Water Purification Forum and industry development conference, offering direct access to regional manufacturing capabilities.

These exhibitions provide comprehensive coverage of China's water purification industry, strategically timed throughout the year. From Xiamen's year-end industry gathering to Shanghai's international platform and Guangzhou's spring showcase, these events offer valuable opportunities to engage with manufacturers, explore new technologies, and establish direct sourcing relationships across China's water treatment ecosystem.

Founder's Corner: Planning Ahead for Success

Congratulations to the new US president, the impact on tariffs will be interesting to watch in 2025, though as always, these costs ultimately reach consumers.

We're entering the year's biggest sales period, and timing is everything. While Black Friday, December, and January present massive opportunities, success hinges entirely on inventory planning. My team and I are here to support you through this crucial season.

Chinese New Year falls early next year - January 29th, 2025. This isn't just another holiday shutdown; it's a significant reset for manufacturing in China. Factory workers traditionally return to their hometowns, and many choose to find new positions after the festivities. This means factories face weeks of hiring and training, often leading to quality variations in the first two months of production.

Combined with peak shipping rates and pre-holiday manufacturing pressure, waiting too long can be costly. October was optimal for Q1 2025 inventory, but there's still time to act in November. Need guidance? We're here to help.

- Jiling

Conclusion:

The water purifier market presents compelling opportunities for e-commerce entrepreneurs, projecting growth to $92.1 billion by 2031. Residential sales dominance (74.3%) and RO system preference (66.3%) create ideal conditions for online retail success, particularly in emerging markets.

Digital channels and smart technology transform consumer engagement with water purification systems. This evolution, combined with strong margins and recurring revenue potential, positions water purifiers as an attractive category for sustainable e-commerce growth.

Looking ahead: In next week's edition, we'll examine the household cleaners market, set to reach $53.3 billion by 2031. We'll explore how manufacturers are adapting to consumer preferences for organic products and sustainable packaging, particularly through concentrated formulas and tablet formats. The Organic Trade Association reports non-food revenue exceeded $5.5 billion in 2020, showing significant potential for this segment despite the market's established players.